Check online status of your Permanent Account Number (PAN) or Tax Deduction Account Number (TAN) application submitted to Income Tax Department. Users can track status of their application by selecting the application type, acknowledgement number, name and date of birth of the applicant. The Process is given below.

- If you Applied for pan Card at NSDL you need to go to this link https://tin.tin.nsdl.com/pantan/StatusTrack.html .

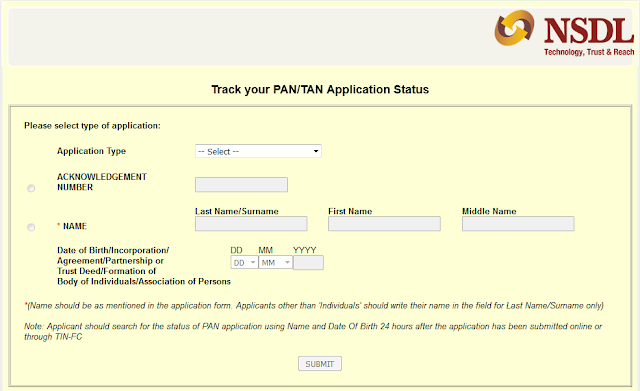

First choose your Application type. If You have acknowledgement Number , Choose Acknowledgement Number And Enter it. If you don,t have Acknowledgement Number , You have to choose Name. Enter Your Name and date of birth and click Submit.

To Know The status Of your Pan Click here

If You applied for Pan Card at UTI You need to go to this link http://www.myutiitsl.com/PAN_ONLINE/trackApp to Check pan status online.

To Check the status of your pan Select your Application Type.

Enter your Application Number or Coupon Number And click Submit

To Know the Status of your Pan Click here

Thanks for sharing the amazing information on how to check the Pan Card Status Online.

ReplyDeletensdl pan card status online

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteCHECK YOUR PAN CARD STATUS

ReplyDeleteuti pan status

ReplyDeletethis post gives me best information. thank you for this informationHow to know your pan jurisdiction by PAN number

ReplyDeleteCheck PAN Card status on UTI. as well as .Check PAN Card Status on NSDL.

ReplyDeleteFor more deatil click here

I am definitely enjoying your website. You definitely have some great insight and great stories.

ReplyDeletepan card status by name and date of birth

Pushpa devi

ReplyDeletePushpa Devi

ReplyDeleteNice Post

ReplyDeleteThis blog was amazing, I feel too good to read it. It is really helpful article

for me.How to Get Lost Pan Card

Really Amazing Post

ReplyDeleteThis blog was amazing, I feel too good to read it. It is really helpful article for me.

how to get uan number

Canara Bank is considered to be the largest public sector bank which is owned by the Government of India. The head quarter of Canara bank is in Bengaluru.IFSC Code Canara Bank, Pune

ReplyDeleteReserve Bank of India (RBI) has launched IFSC codes which stand for Indian Financial System Code. This code was introduced by the RBI in order to ensure security and safety of the transactions.

Personally I think overjoyed I discovered the blogs.

ReplyDeleteHow to Apply for PAN Card and Check Status Online

real beautiful Article, Thanks for sharing!

ReplyDeleteHow to Apply for PAN Card

Offline procedure to use for the Lost PAN card

ReplyDeleteOne will get the appliance kind for “request for brand spanking new PAN changes or correction in PAN data’ form from any TIN-facilitation centres or any IT PAN Service centres or PAN centres etc.

The form can even be downloaded from the revenue enhancement Department web site, UTIITSL web site, NSDL web site.

The PAN form ought to be crammed in block letters and with black ink.

The required details within the kind ought to be crammed in West Germanic language solely.

Applicants ought to mention their existing ten-digit PAN variety.

Applicants should ensure that only 1 character is crammed in each box provided and will leave a box blank once every word.

In case of a personal soul, 2 recent pictures ought to be glued within the area obtainable on the highest of the shape.

The soul signature or left-hand thumb impression is critical across the icon placed on the left-hand facet of the shape.

A complete signature or the left-hand thumb impression ought to be worn out the box provided on the proper facet of the appliance kind.

The thumb impression ought to be punctually genuine by any justice or any gazetted government officer beneath his/her official seal and stamp.

The payment ought to be paid as money or cheque or DD at the counter throughout the submission of the appliance kind.

ADVERTISEMENT

ReplyDeleteAwesome Article, Thanks for sharing!

How to Apply for PAN Card Online (Step by Step Guide)

ReplyDeleteThe quality of your articles and listing is really attractive.

Get Your PAN Card Details By Name, Address and DOB

Nice information! Thanks for sharing!! pan card verification api

ReplyDeleteWow! amazing post.. Thanks for sharing!

ReplyDeleteGet Your PAN Card Details By Name, Address and DOB

Sar mera pan card kase pata lagega mai pameant kardiya kuch masej nahi

ReplyDeleteCyrus Technoedge Solutions is a renowned company in the field of mobile recharge software portals. We provide the best recharge software, recharge API, money transfer API and software, bulk SMS, long code, etc.

ReplyDeleteonline recharge software provider in india